georgia estate tax rate 2020

2020 Georgia Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Georgia uses a relatively simple progressive income tax system with rates ranging from 100 to 575.

Income Tax Rates and.

. 31 2020 may be subject to an estate tax. The top estate tax rate is 12 percent. Maine for example levies no tax the first 58 million of an estate and taxes amounts above that at a rate of 8 percent to a maximum 12 percent.

The Georgia County Ad. The millage rates below are those in effect as of September 1. Estate Tax - FAQ.

EY Payroll Newsflash Volume 19 069 2018-5. Georgia Residents Income Tax Tables in 2020. Georgia estate tax rate 2020.

Nevertheless you may have. If the value of what the heir will receive is at or. The top Georgia tax rate has decreased from 575 to 55 while the tax brackets are unchanged from last year.

The rate remains 40 percent. Georgia estate tax rate 2020. Georgia law is similar to federal law.

Georgia income tax rate and tax brackets shown in the table. Tax amount varies by county. Even though there is no state estate tax in Georgia you may still owe money to the federal government.

260 plus 24 percent of the excess over 2600. Georgia has no inheritance tax. July 07 2021.

For 2020 the estate tax exemption is set at 1158 million for individuals and 2316 million for married couples filing jointly. Georgia Estate Tax Rate 2020. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold.

For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158 million. Object Moved This document may be found here. Under federal tax law estates with fewer than approximately 5 million in assets are not subject to estate taxes.

083 of home value. The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000. As of July 1 2014 Georgia does not have an estate tax either.

Generally a person dying between Jan. The Georgia State Legislature will decide during its 2020 session to temporarily reduce the maximum tax rate to 55 for 2020. Does Georgia have an estate tax.

Counties in Georgia collect an average of 083 of a propertys assesed fair. Search any Ideas in this website. Due to the high limit many estates are.

The approved 2020 General Fund millage rate of 9776. Georgias estate tax is based on the amount allowable as a credit for state death taxes on the federal estate tax return Form 706. People with higher incomes pay higher rates although Georgias.

1536 Heritage Pass Milton GA 30004 in 2020 Heritage. Dor and county tag offices mv operations. 25 for every 1000 of assessed value or 25 multiplied by 40 is 1000.

The Tax tables below include the tax rates thresholds and allowances included in the Georgia Tax Calculator 2020. By Busch Reed Jones Leeper PC. 2020 Estate Gift GST and Trusts Estates Income Tax Rates Estate tax.

In a county where the millage rate is 25 mills the property tax on that house would be 1000. Compare your take home after tax and estimate your tax. Local governments adopt their millage rates at various times during the year.

For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158 million. Counties in Georgia collect an average of 083 of a propertys assesed. The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000.

Use the tax table in the federal instructions to compute. Then you take the 1158 million number and figure out what the.

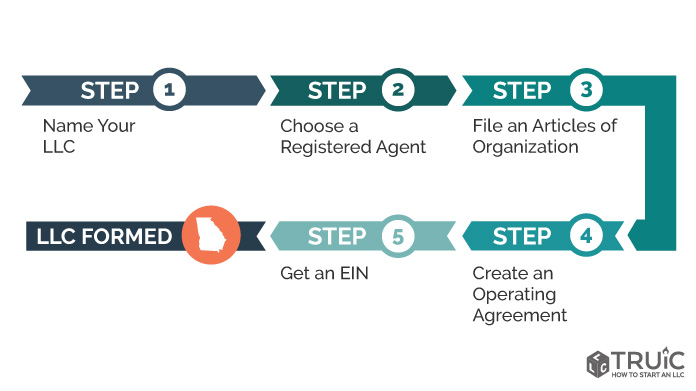

Llc Georgia How To Start An Llc In Georgia Truic

Georgia Estate Tax Everything You Need To Know Smartasset

Tax Rates Gordon County Government

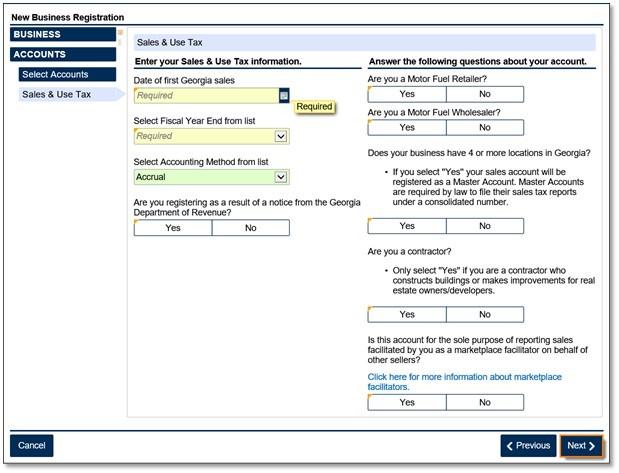

Marketplace Facilitators Georgia Department Of Revenue

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

Llc Georgia How To Start An Llc In Georgia Truic

Georgia Sales Tax Small Business Guide Truic

Georgia State Taxes For 2022 Tax Season Forbes Advisor Forbes Advisor

Georgia Estate Tax Everything You Need To Know Smartasset

Tax Rates Gordon County Government

Property Taxes Laurens County Ga

State By State Guide To Taxes On Retirees States And Capitals Funny Retirement Gifts Retirement

2021 Property Tax Bills Sent Out Cobb County Georgia

Lower Property Tax Atlanta Ga Property Tax Firm Atlanta Property Tax Housing Market Tax Consulting

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

3900 Tuxedo Rd Nw Atlanta Ga 30342 Mls 5985649 Zillow Colonial Farmhouse Real Estate House Styles